Platinum Equity has recently announced it has signed a definitive agreement to acquire Bolton, Ontario based Husky IMS International Ltd. (“Husky”). The transaction is expected to close during the second quarter of 2018. Members of Husky’s management team will remain significant investors in the business through continued equity ownership.

“Husky is an extraordinary company with a well-deserved reputation for developing the industry’s most innovative technology,” said Louis Samson, the Platinum Equity Partner who led the transaction. “John Galt and his team have built one of Canada’s most successful enterprises and a truly world class industrial company. We are excited to partner with such an exceptional leadership team and we aim to help them continue raising the bar.”

|

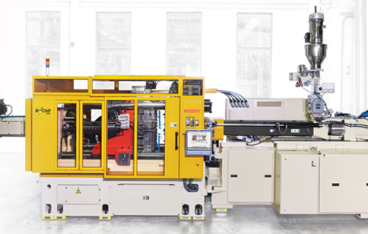

Husky is a leading industrial technology provider to the plastics processing community that has an unprecedented level of innovation effectiveness. Over the last several years, Husky has worked with its investors to successfully advance state-of-the-art manufacturing equipment, which it delivers to its wide range of customers in various end-markets across the globe. Platinum Equity will be purchasing the company from Boston based private equity firm Berkshire Partners LLC, and OMERS Private Equity Inc., the private equity arm of OMERS, the defined benefit pension plan for Ontario’s municipal employees. Berkshire Partners LLC and OMERS acquired Husky in June of 2011.

Demand for Husky’s products and services is primarily driven by growth in the beverage packaging segment, as well as in plastics consumables. Husky is a truly global enterprise with approximately 75 percent of its sales generated outside North America. In addition to complete injection molding solutions, Husky provides aftermarket services and parts to a large and growing installed base of systems globally. Husky’s highly experienced and talented management team will continue to lead the company.

“In Platinum, Husky has found a partner that brings a wealth of experience, a highly capable team, and a shared enthusiasm for building great companies. I am confident that by working together we will find new and exciting ways to serve our customers,” said John Galt, Husky’s President and CEO.

Baird, Goldman Sachs and CIBC Capital Markets acted as financial advisers to the Company; Weil, Gotshal & Manges and Torys acted as legal counsel.

About Husky IMS International Ltd.

Husky is a leading global supplier of injection molding equipment and services to the plastics industry. The company has more than 40 service and sales offices, supporting customers in over 100 countries. Husky’s manufacturing facilities are located in Canada, the United States, Luxembourg, Austria, Switzerland, China, India and the Czech Republic.

About Platinum Equity

Founded in 1995 by Tom Gores, Platinum Equity is a global investment firm with $13 billion of assets under management and a portfolio of more than 30 operating companies that serve customers around the world. The firm is currently investing from Platinum Equity Capital Partners IV, a $6.5 billion global buyout fund. Platinum Equity specializes in mergers, acquisitions and operations – a trademarked strategy it calls M&A&O® – acquiring and operating companies in a broad range of business markets, including manufacturing, distribution, transportation and logistics, equipment rental, metals services, media and entertainment, technology, telecommunications and other industries. Over the past 22 years Platinum Equity has completed more than 200 acquisitions.